Shareholder Information

Peoples Bancorp

- Peoples Bancorp is the bank holding company for Peoples Bank, and all shares in the company are in Peoples Bancorp.

- The holding company was formed in 1982 as Independent Bancorp.

- Because of historical name and structure changes, certificates issued to Peoples State Bank, Peoples Bank, Independent Bancorp, and Peoples Bancorp remain valid.

- Peoples Bancorp is closely held and privately traded, and the company serves as its own transfer agent for any transfers of shares.

- We maintain lists of prospective buyers and sellers of Peoples Bancorp stock.

- Current shareholders may request a copy of the prospective buyers list.

- Those interested in purchasing shares may request a copy of the prospective sellers list.

- You may also request to be added to either list.

- Book value is updated monthly and can be provided upon request to active shareholders.

- The Shareholder system is separate and distinct from Peoples Bank. Please note that address changes do not occur in the shareholder system automatically.

- We prefer to pay dividends by ACH if possible. Please reach out if you would like to set this up.

Strong Numbers

For over 100 years, Peoples Bank has provided Pacific Northwest communities with safe, sound, and local financial solutions. We remain focused on long-term stability instead of short-term profits and minimize risk by maintaining a diversified portfolio while meeting the credit needs of our community. In their most recent ratings, Bauer Financial awarded Peoples Bank a superior rating of five stars. Our strong numbers are more than a commitment to financial performance, they’re a commitment to remaining safe and sound for generations to come.

Peoples Bank is a proud member of the FDIC

Important Dates

Annual

Meeting

The Annual Shareholders Meeting is typically held virtually in June.

Dividend

Payout

Dividends are generally paid once per year in January.

1099-Div Distribution

1099-Divs are mailed in January.

Shareholder Inquiries

All inquiries should be directed to Shareholder Relations by email or phone.

Recent News

Thank you to everyone who participated in our annual customer survey! Your feedback, collected in this survey and others throughout the year, is invaluable as we strive to enhance your banking experience.

The location of your home is forever, everything else is up to you. Learn more about the HomeStyle Renovation Loan from Peoples Bank.

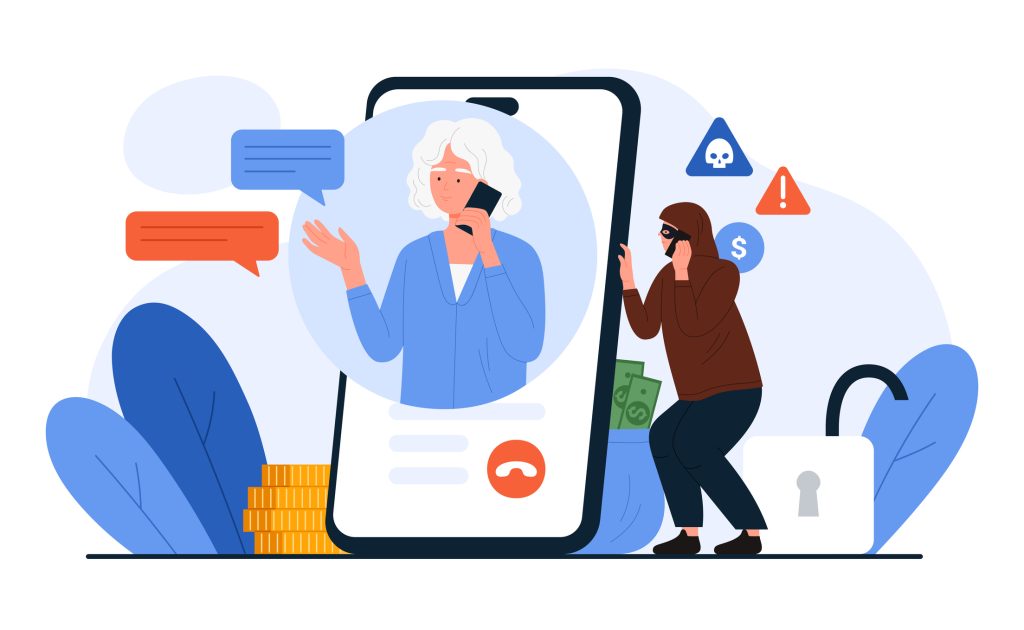

Fraud tactics vary, and scammers quickly create new, deceptive ways to deceive customers. Please remember these important tips before proceeding with any conversation or transaction.

You, or someone you know, could become the victim of a growing crime in America — financial exploitation of older Americans. Criminals are targeting people of all ages, and especially older people of exploitation.